Politics

Marijuana Research Bill Would Have Little Impact On Federal Budget, Congressional Analysts Say

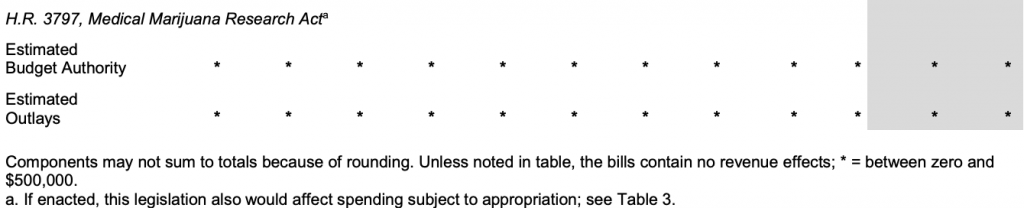

A House-passed bill to promote marijuana research would have virtually no impact on the federal deficit, according to a new analysis from the Congressional Budget Office (CBO).

The bipartisan legislation would streamline cannabis research in part by allowing scientists to access products from state-legal dispensaries. It also contains provisions mandating that the Drug Enforcement Administration approve additional marijuana manufacturers.

Because those facilities are charged registration fees, “which are treated in the budget as reductions in direct spending and spent without further appropriation,” CBO estimates that “the net effect on direct spending stemming from the new fees and spending would be negligible each year.”

Via CBO.

Under the Medical Marijuana Research Act, the U.S. Department of Health and Human Services would be required issue guidance on cannabis research and submit a report to Congress within five years after enactment to overview the results of federal cannabis studies and recommend whether they warrant marijuana’s rescheduling under federal law.

Implementation costs for those components are estimated to be $3 million from 2021-2025, “assuming appropriation of the estimated amount,” CBO said.

Via CBO.

A week after the House approved the research bill, the Senate passed similar legislation, though it did not contain the provision providing scientists with the opportunity to obtain cannabis from the state-legal commercial market.

There’s little time before end of the session in early January, but because the House advanced their version, that raises the chances that some form of cannabis research legislation could cross the finish line sooner rather than later.

One possibility would be for the House to immediately move to pass the Senate bill, which would send it to President Trump’s desk.

However, if House lawmakers insist on something closer to the bill they already passed this month, the resulting negotiations could mean that lawmakers might not reach an agreement on a unified version until some time in 2021.

Meanwhile, prior to the research vote, the House approved legislation to federally legalize marijuana. That measure stands almost no chance of moving through the GOP-controlled Senate this session, but CBO did score it nonetheless and found that it would create about $13.7 billion in net revenue for the U.S. Treasury over the next decade.

About $8 billion of those funds would be derived from businesses taxes on the cannabis market, including income and payroll taxes. Another $5.7 billion would come from a separate excise tax, revenue from which would partly fund social equity programs such as job training, legal aid and other services to communities disproportionately impacted by the war on drugs.

These are just two of relatively few cannabis-related bills that CBO has scored. The department reported last year, for example, that House-passed legislation to protect banks that service the marijuana industry from being penalized by federal regulators would save federal dollars and increase deposits to financial institutions by about $1.4 billion starting in 2022.

CBO also analyzed an earlier bill on marijuana cultivation for research purposes as well as legislation on clinical trials of medical marijuana by the U.S. Department of Veterans Affairs (VA) and letting VA doctors recommend marijuana to patients. Each of those were estimated to have little to no impact on the federal budget.

Marijuana Advocates Raise Concern About Social Equity Problem In House-Passed Legalization Bill