Politics

2021 Sees Republican Lawmakers Take Lead On Marijuana Legalization In More U.S. States

Marijuana legalization has long been seen as a blue state issue, with Democratic lawmakers far more favorable toward the policy change than Republicans even as GOP voters have warmed to cannabis reform in recent years. But in legislatures across the country this year, there are signs that’s finally starting to change.

In at least 10 states, Republican lawmakers have taken lead roles in crafting and sponsoring legislation to legalize cannabis in 2021 legislative sessions. In some, such as North Dakota, GOP-led bills are on pace to potentially become law, while in other states like New Mexico, Republicans have submitted legalization proposals alongside their Democratic colleagues, coming to the table to craft bipartisan compromises.

In yet other states, including New Hampshire and Missouri, Republicans have introduced marijuana legislation but have so far struggled to gain momentum for their bills. Even there, the bills’ conservative lawmakers have staked an ideological claim to legalization, arguing the change would better respect individual liberties and end wasteful spending on a failed government drug war.

“This initiative will increase personal freedom, allow law enforcement to focus on violent crime instead of nonviolent marijuana users, and provide revenue for infrastructure, broadband, and drug treatment,” Rep. Shamed Dogan, a Missouri Republican, said after prefiling a legalization bill for this session.

It’s a rare example in today’s divided age of lawmakers finding common policy ground across party lines. While some of the Republicans teaming up with Democrats to legalize cannabis are moderates, others remain sharply partisan on other issues. Florida Republican Rep. Anthony Sabatini, for example, a sponsor of bipartisan legislation to legalize cannabis for adults in that state and allow past convictions to be expunged, has previously tweeted QAnon conspiracy theories and criticized Black Lives Matter protestors as “disgusting, lawless thugs.”

The cross-country wave of Republican lawmakers embracing legalization comes after voters in several GOP-leaning states, such as Montana and South Dakota approved cannabis reform measures on their November ballots, which might be influencing more politicians across party lines to embrace the issue.

Here’s a list of states where Republican lawmakers have taken lead roles in introducing legislation to legalize marijuana in 2021.

Florida

Among a flurry of legalization proposals introduced in Florida this session is a bipartisan effort led by Sen. Jeff Brandes (R) and Rep. Carlos Guillermo Smith (D) to allow the state’s medical marijuana treatment centers to sell cannabis products to adults 21 and older. The legislation (SB 710 / HB 343) would allow possession up to up to 2,000 milligrams of THC and up to 2.5 ounces of smokable cannabis so long as they were purchased from a licensed retailer. Registered medical marijuana patients and caretakers would be exempt from sales tax on cannabis products.

Homegrow would initially be prohibited under the proposal, although the bills would direct the state Department of Agriculture and Consumer Affairs to “conduct a study on the potential harms and benefits of allowing the cultivation of marijuana by members of the public for private use, including the use of a cooperative model.” That report would be due to lawmakers by January 2022. People with past convictions for certain low-level cannabis crimes could petition a court to expunge the charges from their criminal history.

The plan would also eliminate the state’s vertical integration requirement, allowing companies to apply for a single license—such as cultivation or retail—or multiple licenses.

Brandes is the lone sponsor of the Senate bill so far. On the House side, the legislation’s lead sponsor and three of the four co-introducers are Democrats, while a fourth co-introducer is Republican Rep. Anthony Sabatini.

Georgia

House Resolution 281, a simple two-page bill from Rep. David Clark (R), would put the question of marijuana legalization to voters. Details of the new system would be largely left up to lawmakers to settle later, although the proposed constitutional amendment would dedicate all fees and taxes from the legal cannabis industry to “substance abuse recovery and prevention, mental illness treatment, and for use by law enforcement agencies in combating and responding to cases of illegal drug use and addictions.”

The amendment would also charge lawmakers with establishing a process to expunge or otherwise vacate past arrests and convictions for cannabis offenses “which would not have been a crime” after legalization takes effect.

Missouri

Republican Rep. Shamed Dogan, chairman of the House Special Committee on Criminal Justice, said earlier this year that he wants “to regulate marijuana as closely as possible to the regulations we have on alcohol, tobacco and other products.” His proposed constitutional amendment to legalize marijuana, House Joint Resolution 30, would would require no special licensing for businesses “beyond that which is applicable for the cultivating, harvesting, processing, manufacturing, packaging, distributing, transferring, displaying, or possession of any nontoxic food or food product,” according to language of the joint resolution. Home cultivation for personal or medical use would also be allowed, with no specified plant limits or other restrictions.

The proposal reflects a popular libertarian view that the government should not interfere with how people use the cannabis plant. It echoes a 2015 proposal from a Texas Republican who said marijuana be regulated under “whatever laws apply to tomatoes.”

So far, however, the proposal hasn’t found traction in Missouri. Introduced at the beginning of the legislative session, Dogan’s bill has yet to be scheduled for a hearing.

—

Marijuana Moment is already tracking more than 800 cannabis, psychedelics and drug policy bills in state legislatures and Congress this year. Patreon supporters pledging at least $25/month get access to our interactive maps, charts and hearing calendar so they don’t miss any developments.

![]()

Learn more about our marijuana bill tracker and become a supporter on Patreon to get access.

—

New Hampshire

Two legalization bills in New Hampshire received GOP support this session but have not advanced beyond committee. One measure is HB 629, sponsored by Rep. Carol McGuire (R) along with four other Republicans and one Democrat. It would legalize possession and personal cultivation of marijuana but, unlike most other legal states, would not establish a commercial market. Adults would be able to grow up to six cannabis plants and possess up to three-quarters of an ounce of marijuana and up to five grams of hashish.

Another bill, HB 237, sponsored by seven Democrats and Republican Rep. John Reagan, would create a system of licensed and taxed cannabis production and sales.

New Mexico

In New Mexico, where House and Senate lawmakers are scrambling to harmonize four separate legalization proposals, a bill by GOP Sen. Cliff Pirtle, SB 288, is a favorite among some Republican lawmakers and has earned Pirtle a seat at the table as sponsors of all four bills work to hammer out a deal on how the proposal will proceed ahead of the end of the session on March 20.

Pirtle said earlier this month that he introduced the measure, which has a lower tax rate than Democrats’ proposals and retains more revenue and control for municipalities, “because I felt something as important as legalizing the sale of recreational cannabis really needed to have a bipartisan approach.”

Another Republican, Sen. Craig Brand, said the bill is “very close” to what he’d like to see in marijuana legislation.

Pirtle’s measure cleared a Senate committee on Tuesday following the House’s passage of one of the other bills last month. “Hopefully we can come up with something that works for everybody,” Pirtle told the Santa Fe New Mexican last week. “We’re working on it.”

North Dakota

North Dakota’s House of Representatives has already passed Republican-led legislation to legalize marijuana, approving. HB 1420 late last month on a 73–21 vote. The measure, which would allow adults 21 and older to possess and purchase one ounce of cannabis but would prohibit home cultivation, now awaits consideration by the Senate Human Services Committee.

The bill, introduced by Rep. Jason Dockter (R), has bipartisan support in the House and in the Senate is sponsored by Sen. Scott Meyer (R). Even if the legislature were to pass the measure, however, it’s unclear whether Gov. Doug Burghum (R) would sign or veto it.

One goal of Republicans in North Dakota is to set their own rules ahead of a possible legalization push at the ballot box. Rep. Matthew Ruby (R) said last month that the legislation’s intent is “to get ahead of the constitutional measure that is already beginning the signature collection,” adding that home cultivation in that proposal would complicate enforcement efforts.

Oklahoma

Oklahoma Republican Rep. Scott Fetgatter is proposing a ballot question to let voters decide whether to legalize marijuana for adults. HB 1961, introduced in early February, would put a referendum to voters on whether to allow the state’s existing medical marijuana dispensaries to sell products to adults 21 and older. Consumers could possess up to an ounce of cannabis and gift that amount to other adults without remuneration.

The measure would impose a 15 percent excise tax on retail marijuana as well as a state and local sales taxes. Revenue would go to the state’s general fund.

The measure faces an uphill battle in the legislature, but Fetgatter is optimistic. “It at least starts a conversation,” he told local NBC affiliate KJRH.

Pennsylvania

A Pennsylvania Republican is one of two leading proponents of a forthcoming bill to legalize marijuana, which advocates hope will make the proposal more appealing to the state’s GOP-controlled legislature. Sens. Dan Laughlin (R) and Sharif Street (D) announced last month plans to introduce legislation that would allow adults to possess up to 30 grams of marijuana purchased from licensed stories. Homegrow would be allowed only for medical marijuana patients.

The bill marks the first time a Republican lawmaker in the state has sponsored an adult-use legalization bill. Laughlin said during a press conference that while he’s not necessarily in favor of cannabis use, he thinks a regulated market is “the most responsible approach.”

“It’s clear to me that public attitudes towards marijuana have changed dramatically in the past decade,” he said, “maybe more than any other issue in recent memory.”

West Virginia

Legislation introduced last week by West Virginia Republican Dels. Brandon Steele and Doug Smith would legalize, tax and regulate cannabis for adults 21 and older. Home cultivation of up to three cannabis plants for personal use would be permitted so long as the marijuana is grown inconspicuously, not sold and not brought across state lines. Unusually under the bill, HB 2919, retail sales would take place only through the West Virginia Cannabis Commission. The commission would also set a wholesale price at which the state would buy cannabis from licensed growers, as well as the base tax rate for the legal system

House Majority Whip Paul Espinoza (R) recently polled GOP colleagues on marijuana legalization as one of a number of possible ways the state could raise revenue to bridge a $2.1 billion loss in revenue expected under a plan to eliminate the state’s personal income tax. He noted that some of the issues on the list “are nonstarters,” but did not share the results of the internal poll.

Gov. Jim Justice (R), meanwhile, said last week that he would support taxing “the absolute crap” out of legal cannabis if the proposal passes the legislature. “If in fact the entire nation is going to move that way, if our legislature from the standpoint of the Republicans in the House were to bring me that, and it would be tied to using those extra dollars [to] get rid of additional personal income tax, I would support it,” Justice said. Days earlier he said legalization could potentially curb opioid-related overdose epidemics in West Virginia.

Wyoming

A Republican-led coalition in Wyoming last week introduced HB 209, a bill that would allow adults 21 and older in the state to purchase marijuana from licensed stores as well as grow cannabis at home for personal use. The lead sponsor on the House side is Judiciary Committee chairman Jared Olsen (R), and seven of the 11 House cosponsors are Republicans—including the House speaker. On the Senate side, the lead sponsor is Sen. Cale Case (R).

If passed, adults could grow up to 12 flowering plants and possess up to a pound of marijuana in their homes, provided that any amount over 2.5 ounces is stored in a locked or otherwise secure area.

The bill is before the House Judiciary Committee and is expected to get a hearing this week.

Contextualizing GOP Support For Legal Marijuana

Beyond the Republican lawmakers who’ve sponsored bills to fully legalize marijuana, even more have embraced relatively modest measures to decriminalize possession or allow medical cannabis.

Others are championing even more far-reaching measures to reform laws around psychedelics and other drugs. Iowa Rep. Jeff Shipley (R), for example, filed legislation this session to decriminalize psilocybin and to allow seriously ill people to access psychedelics.

But despite the growing number of individual GOP officials who are beginning to lead reform efforts, Democrats as a whole are still much more likely to support legalization than their Republican counterparts.

When Virginia lawmakers sent Gov. Ralph Northam (D) a cannabis legalization bill last month, not a single GOP member of the legislature was on board. And while West Virginia Gov. Jim Justice (R) has reluctantly said he would sign marijuana legislation if sent to his desk, nearly a dozen Democratic governors across the country this year have used their State of State addresses or budget proposals to proactively push cannabis reforms.

The partisan divide on legalization remains especially evident in Congress, where top Democratic lawmakers have signaled the policy change is a priority this year. When the U.S. House of Representatives passed a bill to end federal marijuana prohibition last year, by contrast, only five Republicans voted in support.

Mexican Committees Approve Revised Marijuana Legalization Bill, With Floor Vote Expected Wednesday

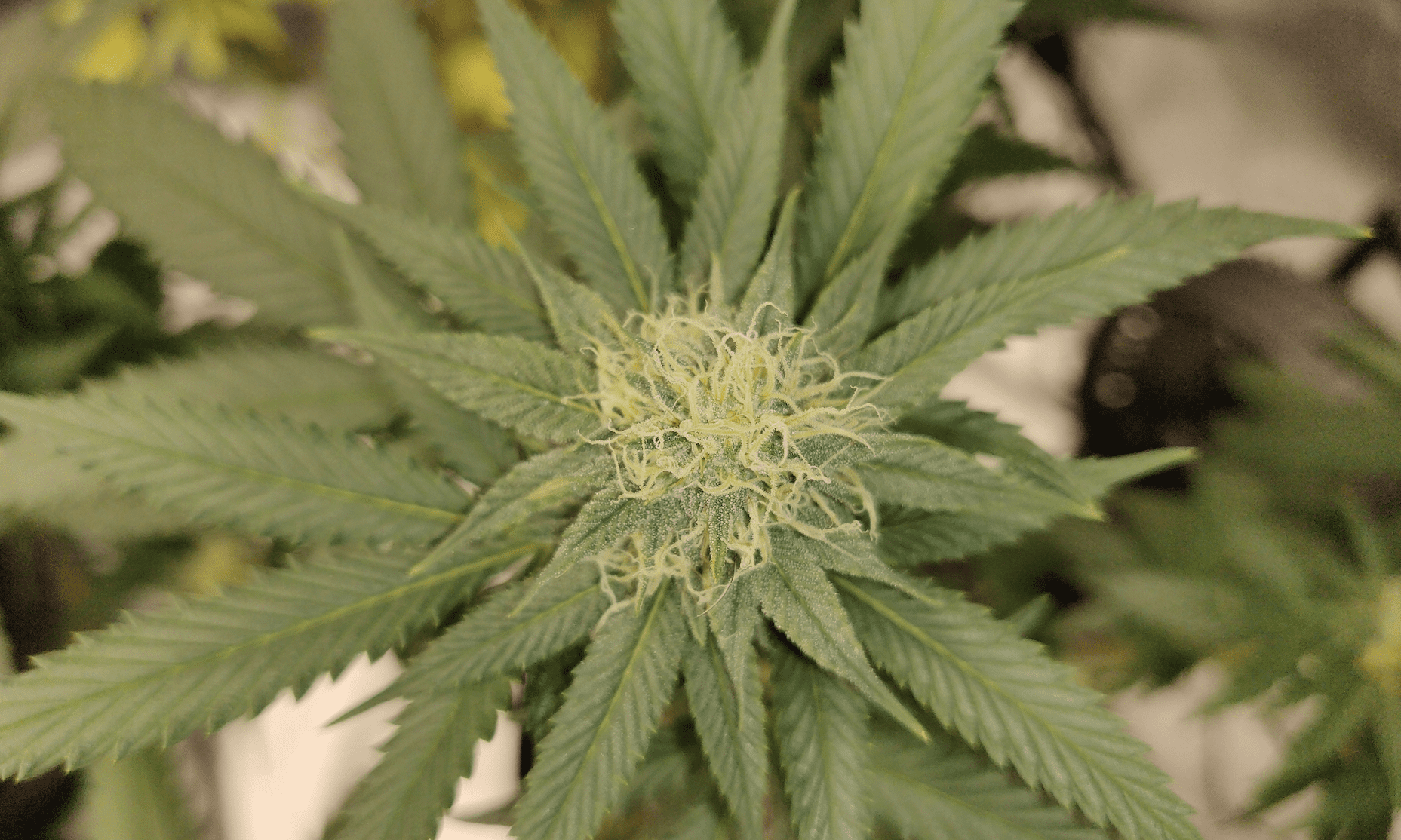

Photo courtesy of Mike Latimer