Politics

Federal Reserve Bank Highlights Economic Potential And Health Impacts Of Marijuana Legalization

A Federal Reserve Bank district recently published a short analysis outlining the potential benefits and consequences of state-level marijuana legalization, noting the economic impact of the policy change as well as the possibility that people will use cannabis as a substitute for alcohol.

It’s a complicated issue for policymakers, an official with the St. Louis division of the central bank wrote, especially as it concerns taxation. Setting tax rates too high could reduce demand for legal marijuana products and send consumers to the unregulated market, but setting them too low could offset revenue to states, Charles S. Gascon, a regional economist and senior coordinator for the Fed, wrote.

States are facing complex decisions on how to regulate marijuana. As more states decide to legalize cannabis, economics comes into play https://t.co/02u7bdzplQ pic.twitter.com/bOohbOQMD1

— St. Louis Fed (@stlouisfed) June 9, 2020

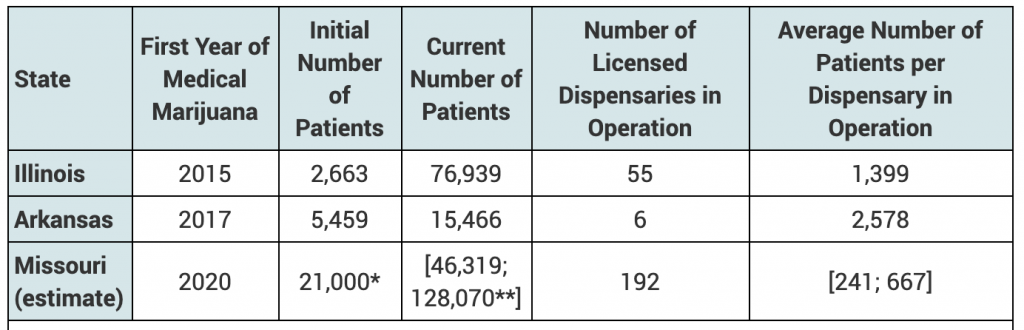

“While public discourse surrounding the legalization of marijuana often revolves around perceptions toward recreational drug use, an economic argument supporting (or opposing) legalization can be made regardless of one’s moral standing on use,” the analysis, which focused on various state medical and recreational programs in the midwestern region, states.

For medical cannabis, the bank said such markets raise “the question of potential medical benefits and costs.”

“One could view any drug from the same lens by asking, do the potential benefits from appropriate use of the drug outweigh the costs or risk of abuse?” But unlike traditional pharmaceuticals, medical marijuana products are subject to sales and excise taxes, making them more like tobacco and alcohol than traditional medicines for economic purposes.

The Fed post also asserts that “recreational use of any drug may create social costs, such as long-term health problems, injuries, accidents, unemployment, vagrancy and crime” and that as result of these social costs, “the free-market price is likely too low and therefore consumption is too high.”

Policymakers are facing complex economic decisions on how to regulate marijuana https://t.co/eRJXGEQgP9

— St. Louis Fed (@stlouisfed) June 9, 2020

“Policymakers can attempt to solve this problem in two ways: first is criminal enforcement, which increases the cost of supplying drugs, reducing supply in the market and subsequently pushing up prices,” it continues. “Second is taxation on purchases, which reduces the quantity demanded in the market by increasing the price. In theory, both policies could achieve the same outcome of reducing drug use to a socially optimal level.”

“Policymakers face the difficult task of taking this theory to practice. Enforcement requires determining the most efficient techniques and the severity of penalization. Policymakers must also account for the adverse consequences of incarceration. On the other hand, taxation requires determining the optimal tax rate, which may vary for different types of consumers. Again, there may be a cost of enforcing this tax on those who seek to avoid payment. For both policies, the main challenge is determining the social cost of drug use, which ultimately determines the degree of necessary enforcement or taxation.”

The financial institution concluded by noting complications created by the federal-state marijuana policy conflict, including the lack of access to banking services for cannabis businesses.

One of the more interesting points the bank made is that consumers “are likely to spend a greater share of their income on marijuana and less on other taxable goods, such as alcohol” when cannabis is legal.

The Federal Reserve Bank of St. Louis seems to have taken special interest in cannabis policy. In February, it posted a notice clarifying that financial institutions no longer have to automatically treat hemp businesses as suspicious under reporting rules.

Last year, the Federal Reserve Bank Of Kansas City analyzed Colorado’s marijuana market and ultimately determined that the cannabis industry is primed to continue to grow as public support for legalization increases, although perhaps not quite at the rate seen in the early years of the policy change’s implementation.

In April 2019, three Federal Reserve Bank presidents united in a call for clarity on rules for providing financial services to the marijuana industry.

Colorado Marijuana Social Equity Businesses Would Be Defined Under New Bill