Business

Marijuana Industry Sees Record Jobs Gains In 2020 Despite Pandemic, New Report Shows

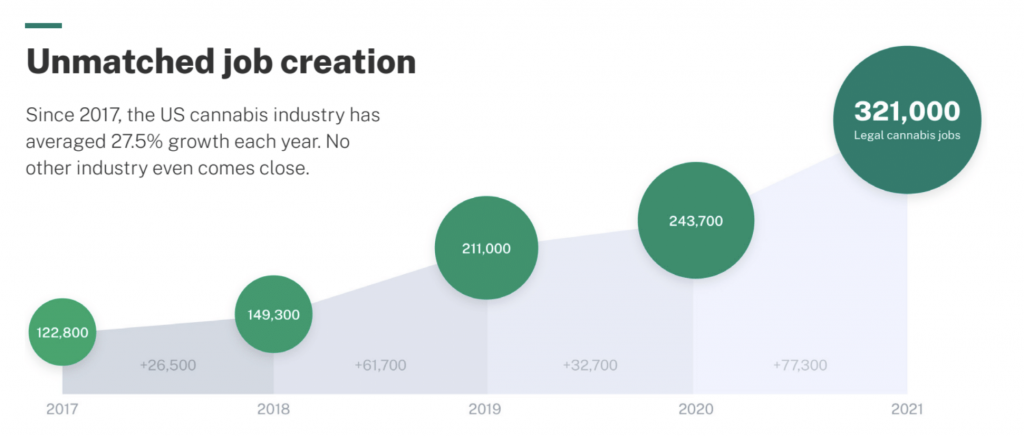

The marijuana industry added more than 77,000 jobs over the past year—a 32 percent increase that makes the sector the fastest in job creation compared to any other American industry, according to a new report from the cannabis company Leafly.

In total, there are now approximately 321,000 full-time jobs in the marijuana sector across 37 states that have legalized the plant in some form. The data bolsters one of the common, bipartisan arguments in favor of reform: legalizing and regulating cannabis is an economic plus.

Via Leafly.

But Leafly’s report—which is based on an independent analysis by journalists, data experts and labor economists at Whitney Economics—is all the more striking considering that it shows significant job growth amid the coronavirus pandemic. At a time when unemployment rates have risen and businesses have been shuttered across the U.S., the marijuana industry has proven resilient.

“We’re proud of the cannabis industry as a bright spot for so many after a difficult 2020 for everyone,” Leafly CEO Yoko Miyashita said in a press release. “The essential cannabis industry is our nation’s unseen and unrecognized economic engine, creating good, full-time jobs that have helped to keep people and local economies afloat.”

“It’s time that our federal policies reflect this reality, and we legalize cannabis while ensuring equity and participation for those disproportionately affected by the War on Drugs, so everyone can benefit from this rapidly growing industry,” she said.

In the past four years, the number of full-time jobs in the marijuana industry has jumped by about 161 percent. While California’s cannabis market has the lion’s share of jobs in the sector (about 58,000), that spike is also largely attributable the state-level legalization movement, which has opened up industries from Massachusetts to Illinois in that time.

Illinois, which has consistently seen record-breaking marijuana sales since retail sales launched last year, added more than 8,000 full-time cannabis sector jobs alone.

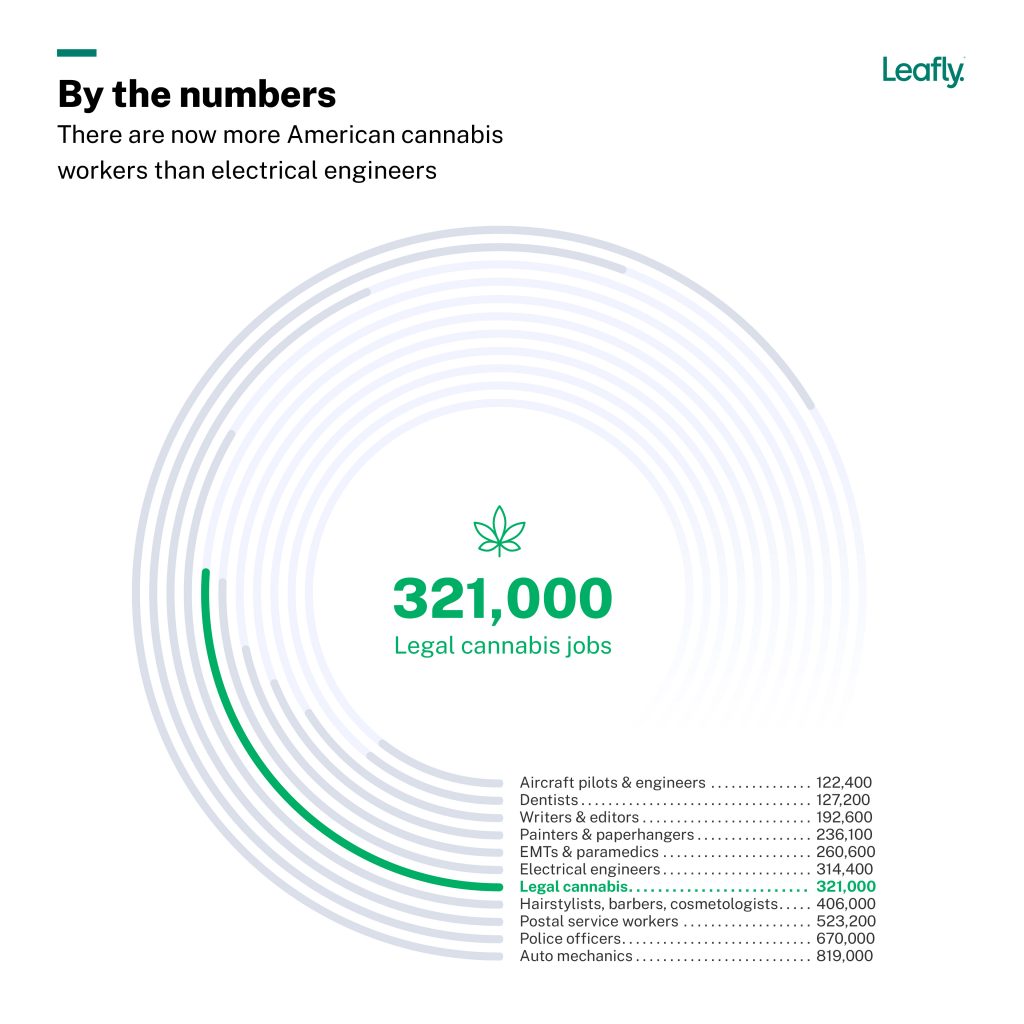

There are now more cannabis workers in the U.S. than dentists (127,200), EMTs (260,600) or electrical engineers (314,400), the report found.

Via Leafly.

In one of the more notable findings, while marijuana sales increased demonstrably—increasing 71 percent from 2019 to 2020—the pandemic did take a hit on staffing.

“The pandemic ultimately drove increased sales industry-wide. But social distancing, occupancy limits, and shelter-in-place orders limited the ability of staff members to occupy a public retail space and work closely together,” the report says.

LEAFLY 2021 #CANNABISJOBS REPORT: The legal cannabis industry added 77,300 full-time jobs in the past year. Our industry now supports 321,000 full-time American jobs. That is an astonishing 32% year-over-year in growth. https://t.co/6bg4Tzp5bi

— Leafly (@Leafly) February 16, 2021

“In some cases, a reverse dynamic came into play,” it continues. “Some booming businesses reported staffing shortages as employees themselves fought off the virus, quarantined due to contact tracing, showed signs of possible infection, or were forced to stay at home due to underlying medical conditions.”

Even as the industry has seen significant gains in consumer purchases, however, Leafly identified a major area of concern among advocates: racial and gender disparities have persisted in the marijuana market.

While there’s limited data at the state level on these demographic trends, an independent database maintained by Cannaclusive found that while black Americans represent about 13 percent of the national population, fewer than two percent of the population own existing cannabis companies.

“The cannabis industry must show true commitment to equity as it expands, so the wealth generated by this new opportunity will uplift minority communities,” the report says. “If it cannot, we will continue to see these communities struggle in the shadow of white supremacy without a fair shot.”

New York Governor To Send Amended Marijuana Legalization Plan To Lawmakers Amid Criticism