Business

Pre-Rolls Are A Key Driver Of The Cannabis Retail Market’s Success (Op-Ed)

“Pre-rolls are now a key component of any smart cannabis retail strategy. They are popular, easy to merchandise and serve as consumer entry points for new brands and formats.”

By Harrison Bard, Custom Cones USA and DaySavers

In today’s cannabis market, pre-rolls are no longer a novelty, they’re essential to retail success. Once seen as an add-on, pre-rolls have become one of the most dynamic and profitable product categories in the industry.

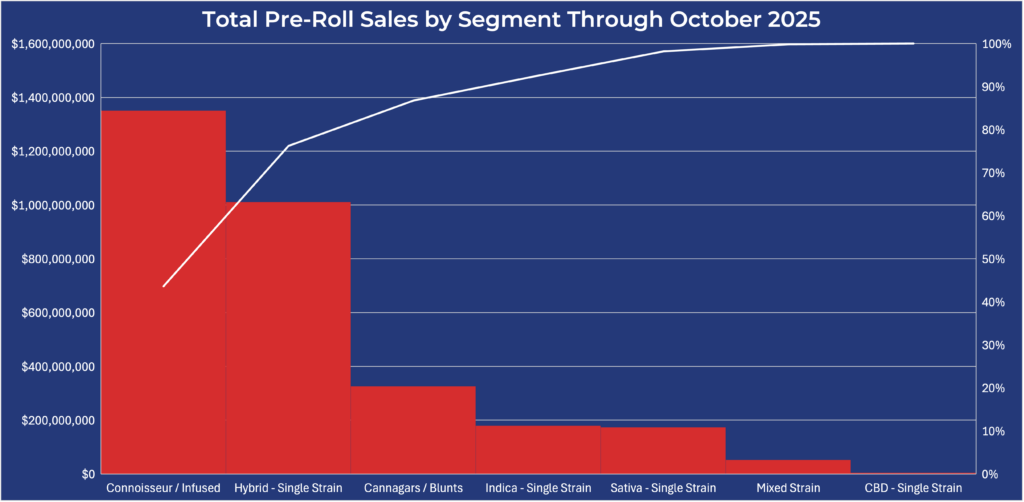

According to 2025 Headset data, over 310.7 million pre-rolls were sold through October, generating nearly $2.8 billion in revenue across 13 recreational markets. That gives the category a 15.8 percent market share, third behind flower and vapes. In Canada, pre-rolls have even surpassed flower to become the country’s top-selling cannabis product.

Driven by convenience, innovation and accessibility, pre-rolls consistently increase basket size, drive repeat visits and stabilize revenues, making them a core pillar of modern retail strategies.

A Category Defined By Variety

At its most basic, a pre-roll is a ready-to-smoke joint; flower packed into a pre-rolled cone or tube with a filter or crutch. But beneath that simplicity lies one of the most diverse and innovative corners of cannabis, with producers infusing concentrates, adding novelty filter tips, offering multi-packs and refining strain combinations to meet a wide range of consumer preferences.

No cannabis product moves more units than pre-rolls. They are perfect for everyday use, sharing at parties and gifting, giving shoppers the opportunity to grab something quick and affordable, test a new strain or splurge on premium infused products combining flower and concentrate.

So what are the top-selling segments of the pre-roll market?

Infused Pre-Rolls: The Top Revenue Engine

Infused pre-rolls dominate in both sales growth and margin contribution. These premium joints combine flower with concentrates like distillate, resin, hash and/or kief, delivering higher potencies and brighter flavors, two things consumers consistently tell us they look for when shopping.

So far in 2025, infused pre-rolls have generated more than $1.1 billion, or 48.5 percent of all pre-roll revenues. That’s up 14 percent year-over-year. They now represent 38 percent of units sold, a 28 percent YOY increase. Given those figures, any dispensary without a wide selection of infused pre-rolls is leaving money on the table.

Single Strain Hybrids: The Volume Leader

While infused pre-rolls top the revenue charts, single strain hybrid pre-rolls move the most units. So far in 2025, this segment has notched about $987.4 million in sales (36.3 percent of category revenue) but leads in units sold at 142.8 million—46 percent of all pre-rolls sold, up 14 percent year-over-year.

Hybrids remain the everyday go-to option for many cannabis consumers, so stocking a diverse selection of hybrid pre-rolls should help ensure a reliable and consistent source of revenue.

Indica And Sativa: Maintaining Balance

Sales drop off beyond hybrids, but Single Strain indica and sativa pre-rolls still represent crucial segments.

Indica pre-rolls brought in $179.1 million in 2025, while sativas generated $160.5 million, an 8.6 percent jump year-over-year.

In units, indicas sold roughly 26 million (up 11.3%) and sativas about 18.8 million (up 8.7 percent).

Each accounts for roughly 6 percent of total category sales and are an important part of the retail balance.

Mixed Strain And CBD Pre-Rolls: Niche But Important

Mixed Strain pre-roll sales declined this year, with revenue down 15.9 percent to $51.9 million and units dropping 6.3 percent to 4.2 million.

Single Strain CBD pre-rolls, representing just 0.16% of category revenue (~$4.6 million on 450,000 units), remain small but growing, up 14.4 percent from 2024.

Though smaller, these segments serve loyal, niche audiences, so retailers should continue to stock limited but steady selections, monitored closely through POS data to prevent over-ordering.

Blunts: Poised For Growth

The blunt segment is a curious case. On paper, it accounts for only 0.47 percent of pre-roll revenue and 0.3 percent of units sold. However, survey data shows that blunts remain the third-most-preferred consumption method among users.

A deeper analysis of the data tells a different story, since infused blunts are grouped within the infused category, skewing visibility. In fact, a closer look at the 200 top-selling products with “blunt” in their name shows $67 million in revenue across 3.5 million units sold.

With this in mind, retailers should make sure to keep in stock a variety of pre-rolled blunts, especially infused blunts, to capture this growing audience segment.

Trends In Packaging And Filter Tips

The top package size in terms of units sold is 1-gram, though often that means multipacks of two half-gram pre-rolls. In fact, the vast majority of the top-selling pre-roll products are multi-packs of half-gram, or 84mm, pre-rolls.

Also growing in popularity are smaller formats (e.g., “dogwalker” 0.3-g, 70 mm pre-rolls), which appeal to trial-minded shoppers. Multi-packs also generally carry higher margins and can satisfy both new and returning customers as they provide both trial-sized formats for experimentation and higher-quantity packs for loyalty and convenience.

Filter tips are another differentiator. Premium tips—such as wood, glass or ceramic—enhance the smoking experience by cooling smoke and reducing particles/resin. These features can elevate the humble pre-rolled joint into a premium accessory, helping justify higher price points and reinforcing perceived value.

Selling Strategies For Maximum Impact

Pre-rolls make perfect impulse or upsell items and are ideally positioned near the register, with clear pricing and eye-catching displays.

Like candy at a grocery checkout, they make a great add-on to any basket.

It’s also key to make sure your budtenders are trained on the strains, infusion types and packaging options so they can suggest pairings or introduce shoppers to new formats, particularly since budtender advice is a top mover of product.

Finally, stay data-driven. Use your POS analytics to track sales and adjust inventory accordingly to avoid overstocking or missing out on trending segments.

Final Thoughts

Pre-rolls are now a key component of any smart cannabis retail strategy. They are popular, easy to merchandise and serve as consumer entry points for new brands and formats.

A balanced pre-roll program that offers a variety of strain, size and pricing options can help dispensaries increase revenue, expand basket totals and strengthen customer loyalty.

Pair that with quality POS data tracking and analysis, and your store can turn pre-roll momentum into lasting, dependable growth.

Harris Bard is CEO and co-founder of Custom Cones USA and DaySavers.