Politics

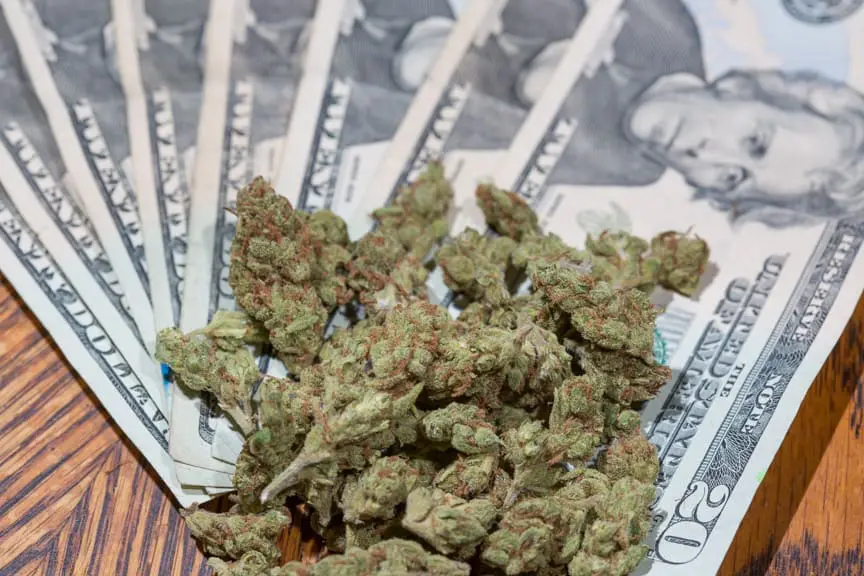

Michigan Court Hears Marijuana Industry Lawsuit Challenging New Tax Increase

“As the leading cannabis trade association, we’re here in court fighting to protect the will of Michigan voters.”

By Katherine Dailey, Michigan Advance

The state’s new 24 percent tax on all cannabis products, which was passed as a part of the fiscal year 2026 budget package, came before the Michigan Court of Claims on Tuesday, with the Michigan Cannabis Industry Association arguing that the tax was unconstitutional.

The hearing was held in Detroit on Tuesday morning.

Since its passage, the tax has been criticized by many cannabis business owners and employees, who say that it will force small retailers out of business and boost the black market.

The association is seeking an injunction to the new law, which is slated to go into effect on January 1, 2026, and is hoping that its lawsuit in Michigan Cannabis Industry Association v. Michigan will result in the tax being struck down.

Specifically, the association argued that the new law seeks to change the language of the 2018 ballot proposal that legalized cannabis in the state, the Michigan Regulation and Taxation of Marihuana Act, which specifically included a 10 percent excise tax on all recreational marijuana purchases. The association said that because the new tax in the 2025 Comprehensive Road Funding Tax Act was passed by only a simple majority vote, and not the supermajority required to amend the law put in place by the ballot initiative, the change bucked the tenets of the amendment.

“As the leading cannabis trade association, we’re here in court fighting to protect the will of Michigan voters,” Rose Tantraphol, a spokesperson for the Michigan Cannabis Industry Association, said in a statement after the hearing. “Michigan voters made their voices heard loud and clear in 2018 when they passed a citizen ballot initiative legalizing cannabis, and this 24 percent wholesale tax was imposed in violation of provisions in the state’s constitution.”

In a court filing responding to the complaint and request for a preliminary injunction, the Michigan Department of Attorney General, representing the state Legislature, argued that the new 24 percent is not an amendment to the original sales tax on marijuana products.

“Given that the [marijuana tax act’s] excise tax is directed only at a retail transaction, the [road funding act’s] wholesale excise tax does not ‘revise, alter or amend’ the [marijuana tax act],” the filing said.

It also notes that the 10 percent tax is imposed “in addition to all other taxes,” according to the law, and as such, it did not directly negate or change the initial law.

The new tax was a crucial piece of the current fiscal year’s budget, and will be used to fund road repairs and new construction, a centerpiece of Gov. Gretchen Whitmer’s goals for her final full year in office. It passed on thin margins in the early morning hours on October 1 after a months-long budget fight.

“There are limited public resources for the state and all the various decisions the state makes with the public fisc, including for Michigan’s infrastructure,” the state’s filing said. “That certain entities might have pecuniary interests that are impacted by legislation does not outweigh the public interests of Michigan’s 10-plus million citizens who travel, and should travel safely, on Michigan’s roads.”