Politics

Arizona Collected More Tax Revenue From Marijuana Than Alcohol And Tobacco Combined, March Data Shows

Arizona generated more tax revenue to the state general fund from legal marijuana sales than from tobacco and alcohol combined last month, state data released last week shows.

Tax deposits to the state general fund from medical and adult-use cannabis reached about $6.3 million in March, compared to $1.7 million from tobacco and $3.7 million from alcohol sales, according to the Arizona Joint Legislative Budget Committee (JLBC).

Beyond that $6.3 million in cannabis tax dollars for the general fund, marijuana excise taxes separately exceeded another $11.9 million last month, for a total of $18.2 million in marijuana revenue—most of which goes to the state, with smaller portions being distributed to cities and counties.

Advocates and stakeholders are touting the March figures. Not only do they underscore the economic opportunity of legalization, but the hope is that providing regulated access to cannabis means fewer people will use more dangerous drugs like alcohol and tobacco.

New JLBC numbers are out.

Tax revenue by industry in March:

Tobacco: $1.7m

Liquor: $3.7m

Cannabis: $6.3mHappy 420, Arizona Taxpayers!

— Arizona Dispensaries Association (@az_dispensaries) April 20, 2022

To that end, alcohol tax revenue did fall short of the JLBC’s projections by $1.4 million, but the analysis did not attempt to provide an explanation or suggest that a substitution effect was in play.

The report also notes that the state separately collected $149.7 million in marijuana tax revenue so far this fiscal year.

Via JLBC.

“These numbers are a clear indication that Arizonans have fully embraced legal cannabis,” Samuel Richard, executive director of the Arizona Dispensaries Association, told Marijuana Moment. “And despite overly constrictive regulation and decades of wrong-headed social policy as barriers, tax revenue far outpaces other recreational categories like tobacco and alcohol.”

“Can you imagine what the fiscal impact would be if the government was a partner in our success, rather than an opponent?” he said.

The state Department of Revenue (DOR) reported earlier this year that Arizona saw more than $1.4 billion in cannabis sales during the first year of adult-use implementation. That figure includes total sales for both recreational and medical marijuana.

While it’s unclear to what extent marijuana legalization might impact alcohol use or sales, Arizona isn’t the only state seeing significant shifts in so-called “sin tax” revenue post-reform.

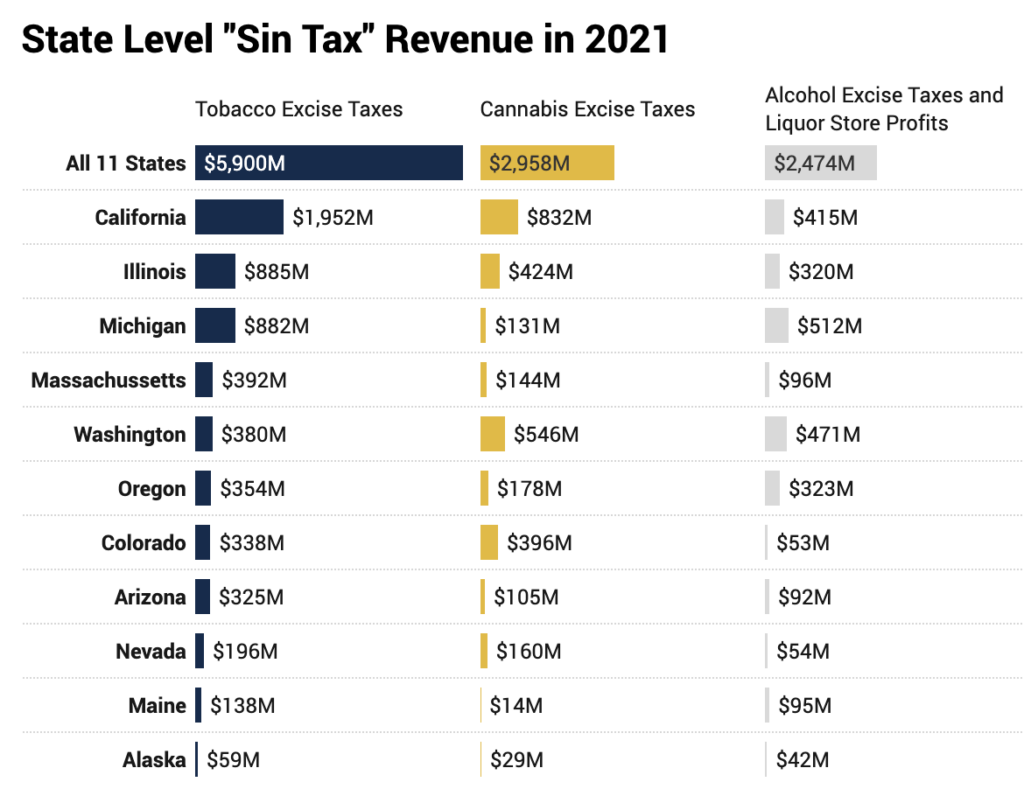

The Institute on Taxation and Economic Policy released an analysis last week that looked at 11 states that have legalized marijuana for adult use and found that, on average, “cannabis revenues outperformed alcohol by 20 percent” in 2021.

Via ITEP.

Massachusetts is collecting more tax revenue from marijuana than alcohol, state data released in January shows. As of December 2021, the state took in $51.3 million from alcohol taxes and $74.2 million from cannabis at the halfway point of the fiscal year.

Illinois also saw cannabis taxes beat out booze for the first time last year, with the state collecting about $100 million more from adult-use marijuana than alcohol during 2021. And new data shows that Illinois’s adult-use market saw its second highest month of cannabis sales in March, reaching $131 million.

For what it’s worth, a recent poll found that more Americans think it’d be good if people switched to marijuana and drank less alcohol than think the substance substitution would be bad.

When asked in the YouGov survey, twenty-seven percent agreed that it’d be ideal if people used more cannabis instead of booze, whereas 20 percent said that would be a bad idea.