Business

Women And Baby Boomers Are Increasingly Embracing Marijuana, New Market Report Finds

In the eyes of experts and the general public, the profile of the “typical marijuana consumer” continues to be a white male under 35, without children, who lives in or near a major West Coast city.

But as the latest “State of Cannabis” report from San Francisco-based marijuana-delivery software platform Eaze suggests, that impression is increasingly wrong.

And that’s good news for cannabis industry investors and entrepreneurs seeking new consumers—who are indeed flocking to marijuana after adult-use cannabis sales became legal in California on January 1, 2018.

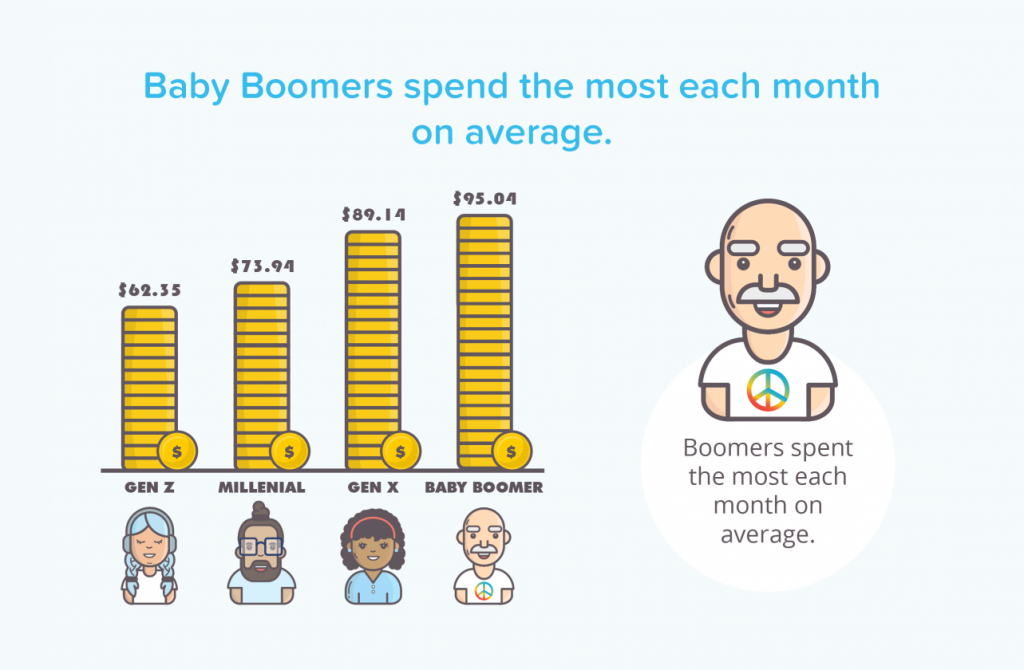

Women and “baby boomers” are the fastest-growing consumer segments among marijuana users, according to Eaze.

Not only that, boomers are spending the most money per order on cannabis than any other generation, according to the report, which was released on Wednesday. (Must be nice to enjoy relative job and housing security and lack crushing student debt!)

Image courtesy of Eaze

The company culled its database of 450,000 consumers as well as answers from 4,000 survey respondents to make the claims contained in the report. It did not define its generational boundaries.

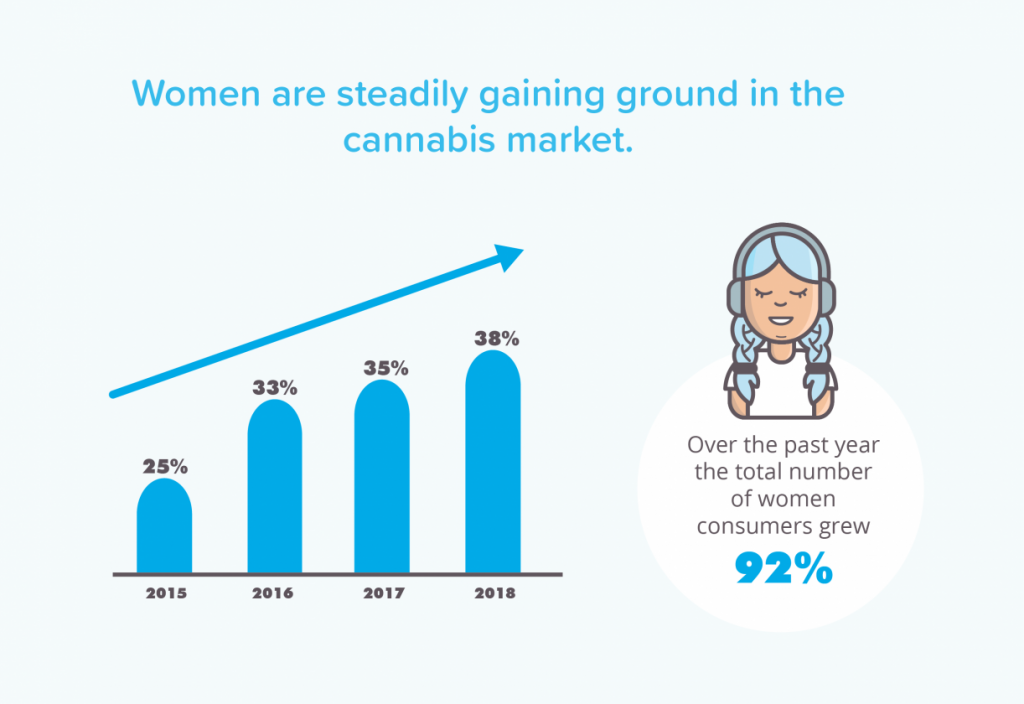

Thirty-eight percent of Eaze customers in 2018 were women, an increase of 3 percent from 2017.

Image courtesy of Eaze

And reflecting both the sizable increase in consumers overall —as well as the vanishing stigma associated with marijuana—the “total number of women consumers grew 92 percent,” according to the report.

Eaze used data from California only for the purposes of the survey, though the platform has long been said to be eyeing expansion into other states.

“First-time buyers,” that is, Eaze customers using the company’s services for the very first time—lured perhaps by the promise of aggressive discounts—grew by 140 percent, according to the report, which did not provide raw figures behind most of the percentages.

Other takeaways:

- CBD, or cannabidiol, the less-psychoactive marijuana compound associated with anti-inflammatory and anti-anxiety effects, continues to grow in popularity. In 2018, 4.8 percent of Eaze’s consumers bought CBD, compared to 2.6 percent in 2017.

- 71 percent of respondents said they are using less over-the-counter pain medication, like Advil, thanks to cannabis—and 35 percent said they are ditching prescription pain pills, like opiates, for marijuana products. Boomers led both categories in ditching pharmaceutical industry medication for marijuana.

- 29 percent of regular CBD customers are “female boomers,” according to Eaze.

- The most popular edible item—among age-verified, adult marijuana consumers purchasing in California’s strictly regulated market—are gummies.

- Marijuana users are replacing both alcohol and tobacco as well as prescription drugs with cannabis. Specifically, 63 percent of Millennials are drinking less, and 32 percent of Gen Z-ers are using less tobacco.

- The most popular reason for using cannabis is as a sleep aid. Eighty-four percent of women and 79 percent of men said they use marijuana for sleep.

- April 20 is a the big cannabis holiday, but by far the top day of the year for sales is “Green Wednesday,” or the day before Thanksgiving.

- Some things aren’t changing. Millennials who probably work in tech—which is to say, Millennials who are probably white and male—still dominate cannabis sales.

- Tech-worker hubs like South of Market and Mission Bay in San Francisco and Venice Beach and Santa Monica in Los Angeles are the top markets for Eaze-assisted marijuana sales. (Which might not be good news if the company wants to expand its market beyond its obvious target demographic.)

- The average age of a cannabis consumer is 31.